The reference rate is an indicator, one of the terms in the formula for determining the coupon for securities with a floating coupon rate, to which the margin is added, subtracted or from which the

margin is subtracted, determining the final value of the rate of a particular coupon period.

The reference rate can be various indicators: most often these are the rates of the interbank market, such as

Libor,

Euribor and others. In addition to them, there are benchmark yields (for example,

the yield of 10-year US treasuries), rates of central banks (for example,

the key rate of the Bank of Russia), IRS rates (for example,

5Y NOK Swap Rate), macroeconomic indicators (for example,

consumer price index (CPI) of Jamaica) and others.

Usually the term and currency of the reference rate are correlated with the length of the coupon period and the currency of issue. For example, if a coupon is paid quarterly in USD, then the reference rate for such an issue is likely to be

3M LIBOR USD), rather than

6M LIBOR GBP, although this is not legally fixed anywhere and there may be exceptions to this rule.

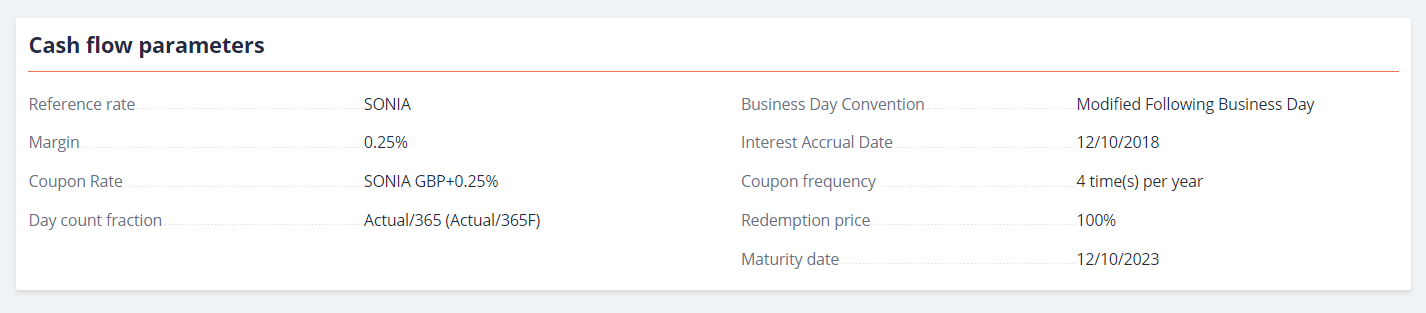

You can see information about the reference rate of each issue on the bonds page in the “Cash flow parameters” block. For example, the reference rate of the Asian Development Bank (ADB), FRN 12oct2023, GBP

(XS1891423078) is SONIA.

Bond Screener

Watchlist

Excel Add-in

API