(Russian accounting standards) is a set of regulatory and legal acts operating in the territory of the Russian Federation and establishing the rules for conducting accounting organizations, as well as the procedure for the preparation of financial statements.

Currently, the norms and rules of the RAS are established by

the Ministry of Finance of the Russian Federation and are valid for organizations registered and operating in Russia.

These standards do not apply to commercial banks (for example,

Sberbank of Russia), non-credit financial organizations (for example,

DOM.RF), or microfinance organizations (

Zaymer), as well as for insurance companies (for example,

Renaissance Insurance) in which accounting and reporting are regulated by

the Bank of Russia.

Russian accounting standards are governed by the following regulatory acts:

1) Federal Law of 06.12.2011 No. 402-FZ "On Accounting"

2) Order of the Ministry of Finance of the Russian Federation of 31.10.2000 No. 94n "On approval of an accounting plan for financial and economic activities of organizations and instructions for its use"

3) Order of the Ministry of Finance of Russia dated July 29, 1998, No. 34N "On approval of the Regulation on accounting and accounting reporting in the Russian Federation"

4) Federal accounting standards established by the Ministry of Finance of Russia

5) Order of the Ministry of Finance of Russia of 02.07.2010 No. 66n "On the forms of Accounting Reporting Organizations"

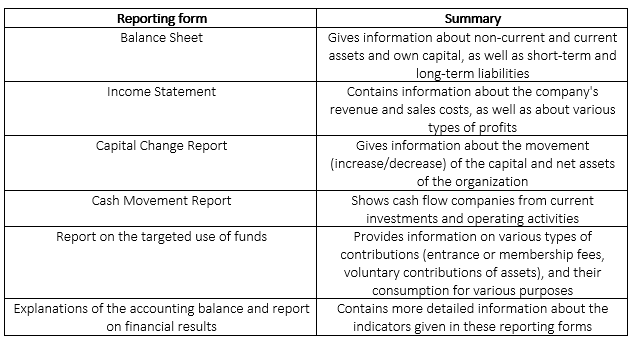

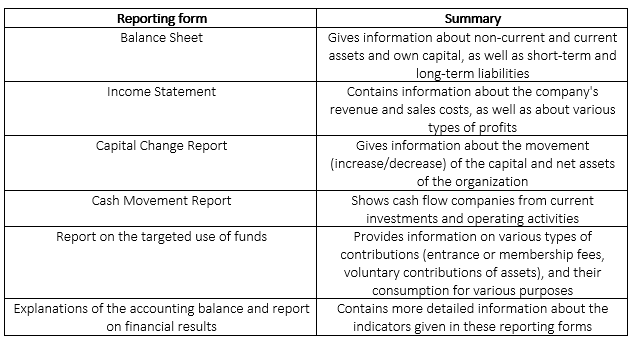

The RAS currently includes the following reporting forms.

RAS reporting is made only in Russian rubles. Since 2020, all organizations subject to the requirements of RAS are required to disclose reporting in thousands of rubles (for example,

Gazprom,

Aeroflot, and

Severstal). Earlier, companies were allowed to draw up reporting in millions of rubles (for example,

Russian Railways published the reporting of the RAS in millions of rubles until the end of 2019).

There are intermediate and annual reporting of the RAS. Intermediate reporting is the reporting that organizations make up for a period of less than a year (for 3, 6, or 9 months). Intermediate reporting typically includes an accounting balance sheet and a report on financial results.

Annual reporting, in turn, is drawn up by the results of the year (for 12 months). In addition to the accounting balance and report on financial results, the annual reporting of the RAS contains reports on capital changes, the movement of funds, and the targeted use of funds (is compiled by non-profit organizations), as well as explanations to the financial statements.

Organizations are required to provide annual reporting to the tax authority no later than 3 months after the end of the reporting period. For example, the reporting for 2020 should be submitted no later than March 31, 2021.

Issuers who have a registered prospectus of securities are required to publish both intermediate and annual reporting of the RAS. Intermediate reporting is usually revealed by them as part of a quarterly report (or in annexes to it), which should be published on a period of not more than 45 days from the date of completion of the quarter. There are

Lukoil, MTS,

Mosenergo,

MMC Norilsk Nickel Group, and

MRSK of Centr among such issuers.

The issuers whose securities have no registered prospectus have the right to publish the reporting of the RAS once a year. Among such companies are predominantly issuers of commercial and high-yield bonds, such as

Optic Fiber,

2M,

Ofir,

ITC Optima, and

YuAIZ. In addition, only the annual reporting of the RAS publishes many companies acting as guarantors, underwriters, or offerors for the issues of Russian bonds (

Novyj Centr,

RS - Aquaculture,

Yakutugol Holding).

Small business entities, non-profit organizations, and residents of Skolkovo can draw up the reporting of the RAS in simplified form. Among the issuers, which in some periods represented a reduced reporting option, such companies can be brought as an example:

Lombard Master,

TEK Salavat,

GruzoVIG System.

Most of the issuers of shares and bonds publish the reporting of the RAS in

the Center of Disclosure of Corporate Information and on its official sites. Reporting, compiled by Russian standards, can also be placed by companies on the websites of

the State Information Resource Accounting (Financial) Reporting,

SKRIN,

Association for the Protection of Investors Information Rights, and

Prime Disclosure, as well as in

the Information Disclosure System in the Securities Market.

Bond Screener

Watchlist

Excel Add-in

API