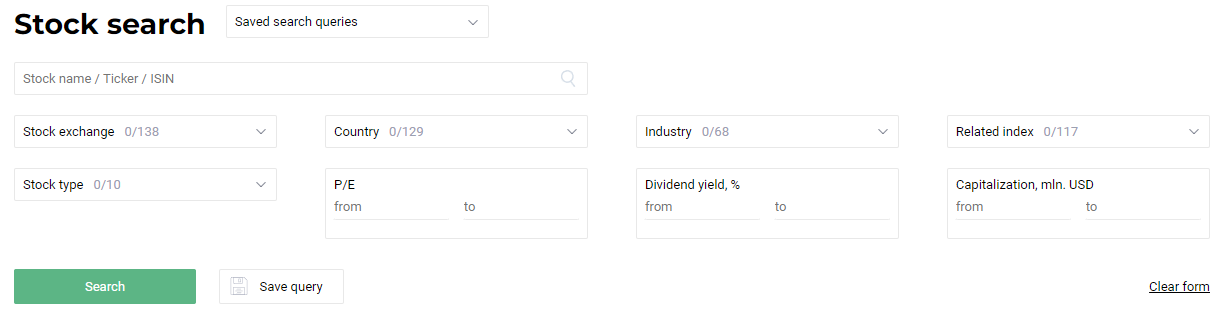

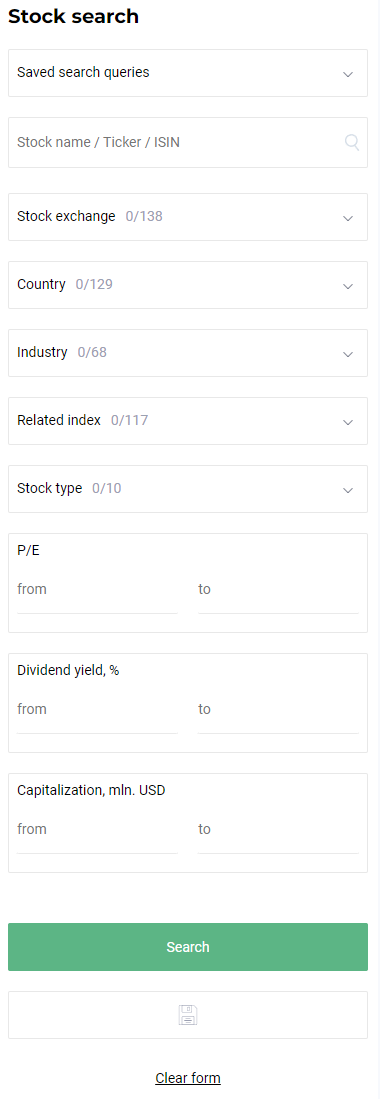

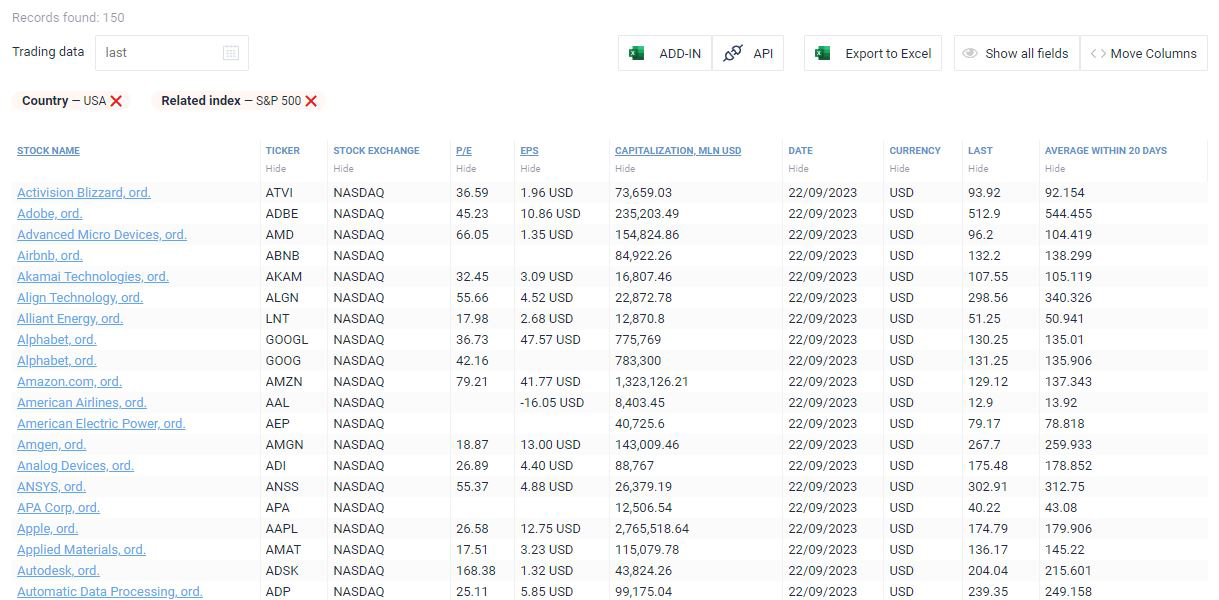

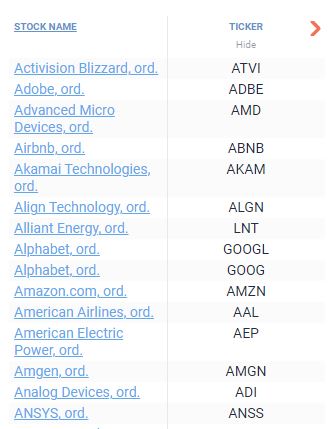

- Tools

-

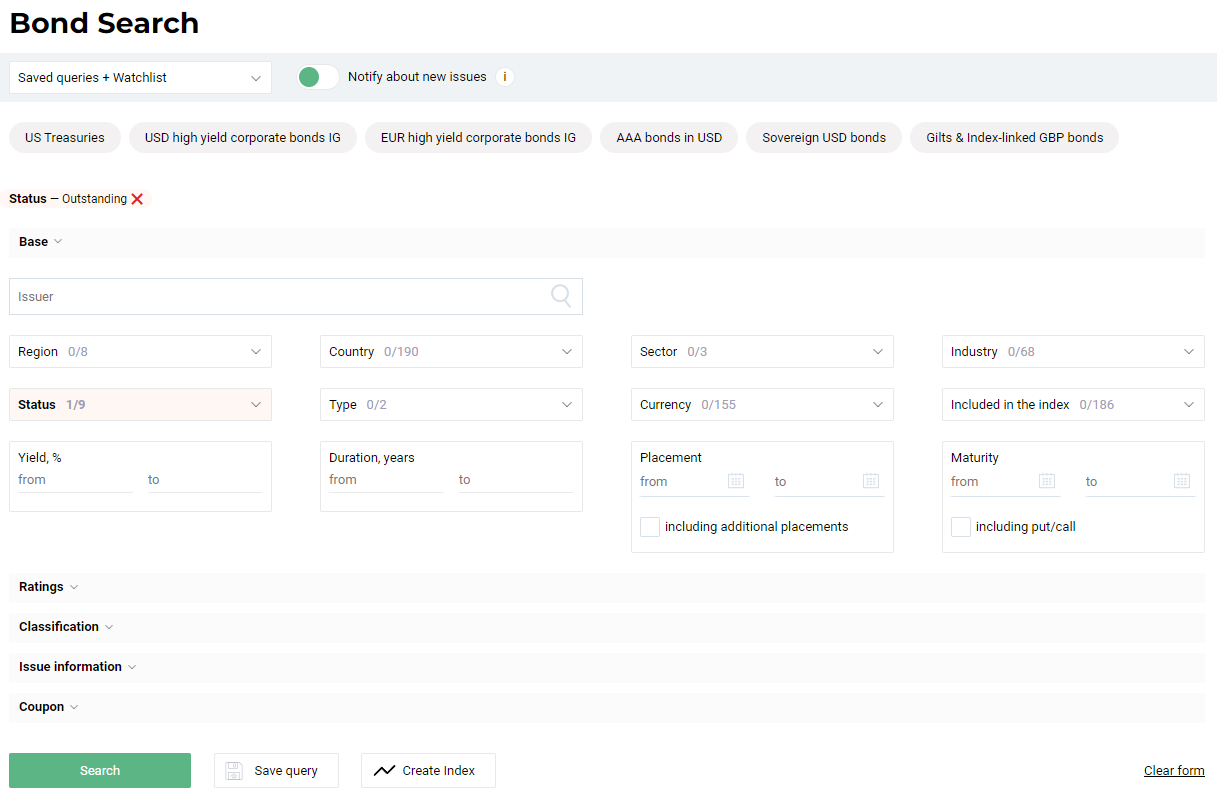

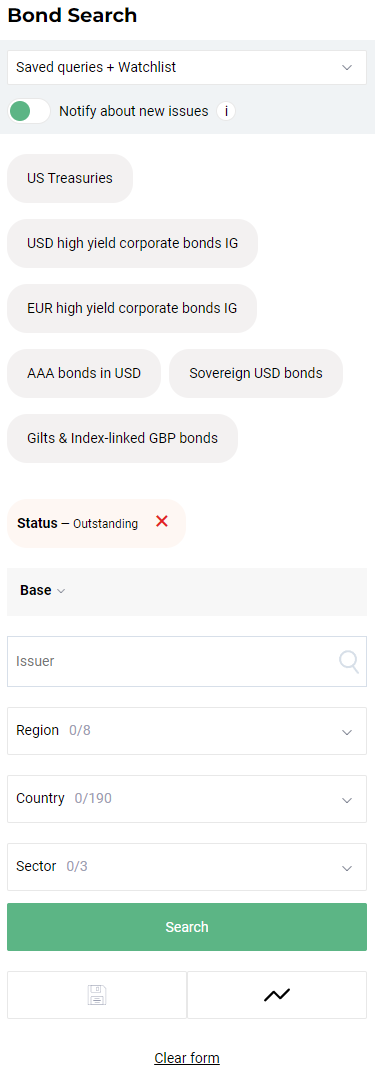

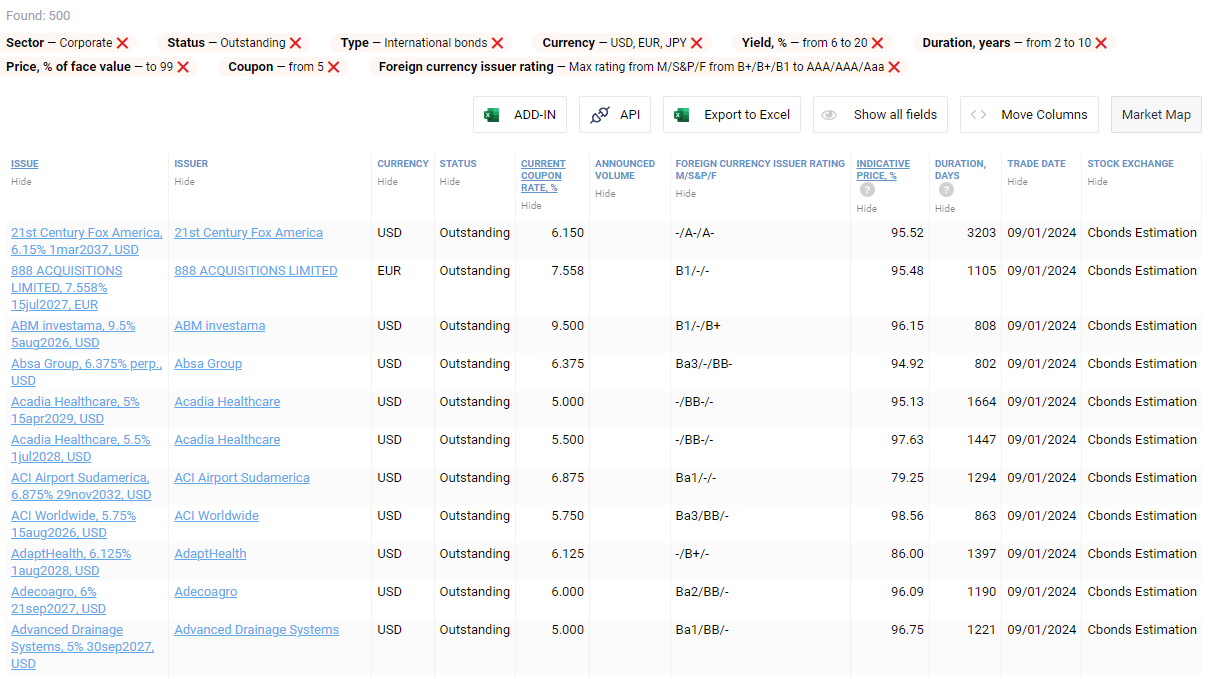

Bond Screener

-

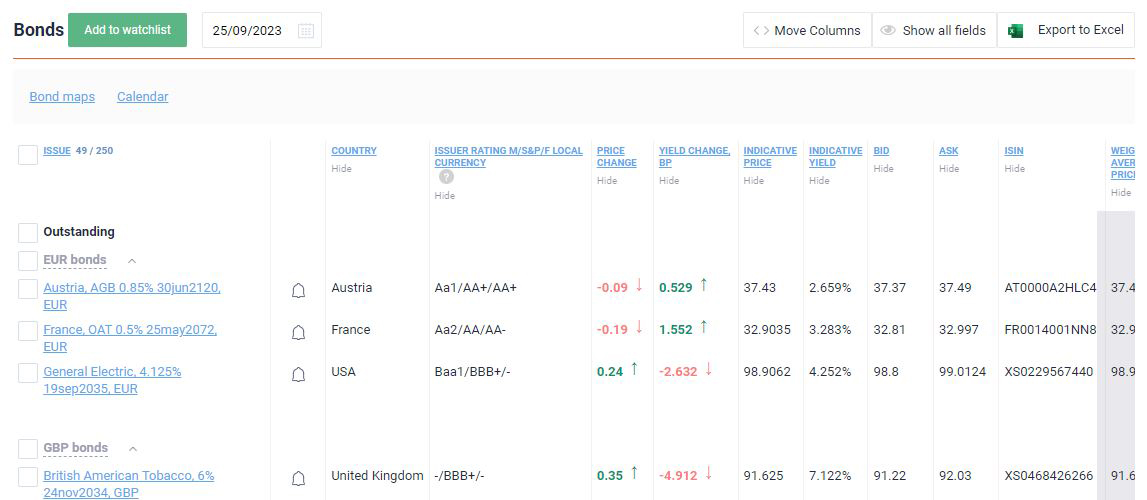

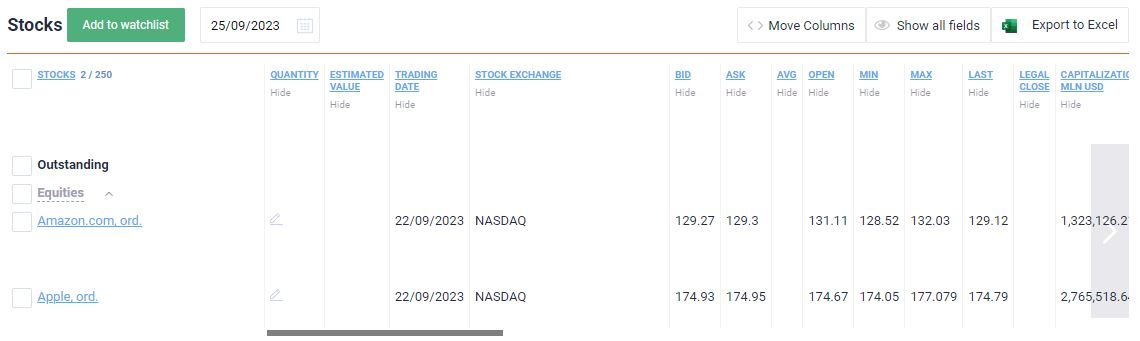

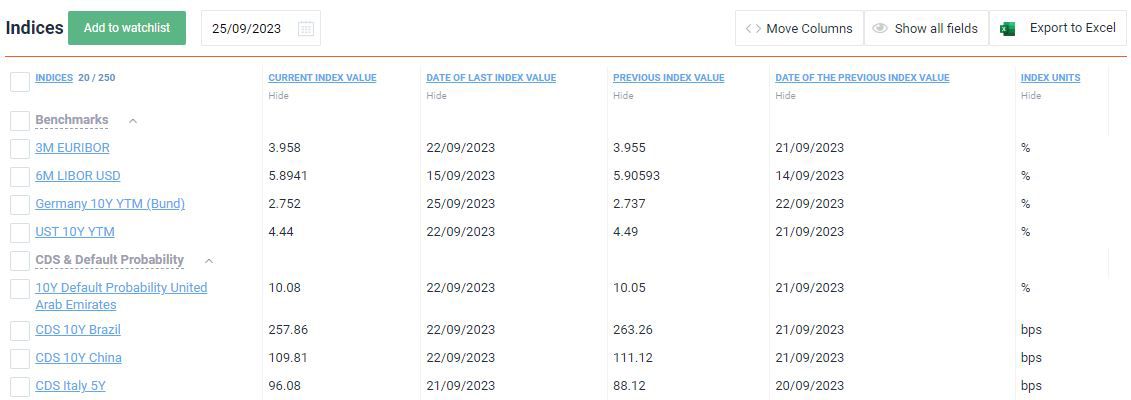

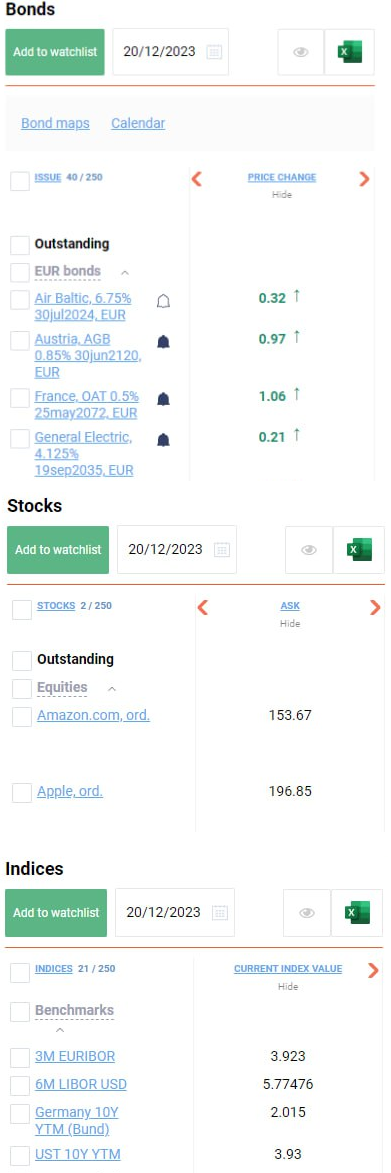

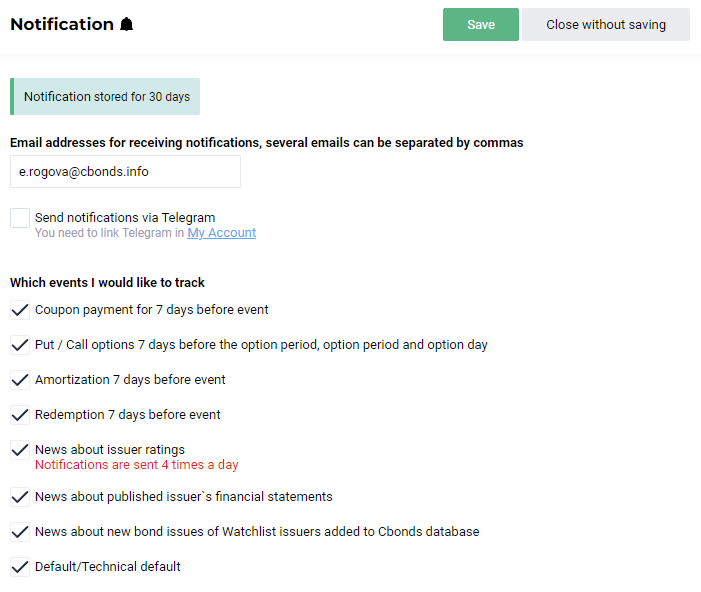

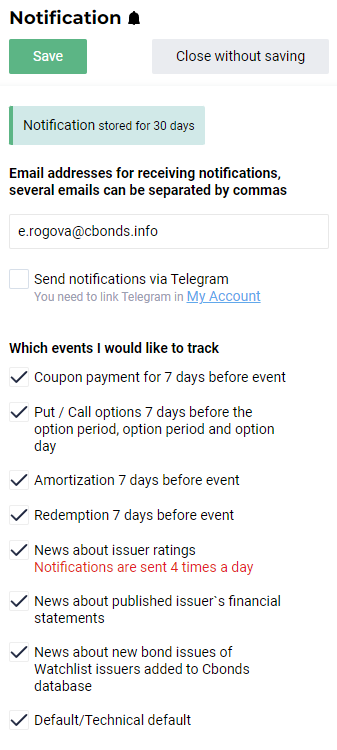

Watchlist

- Bonds

- Stocks

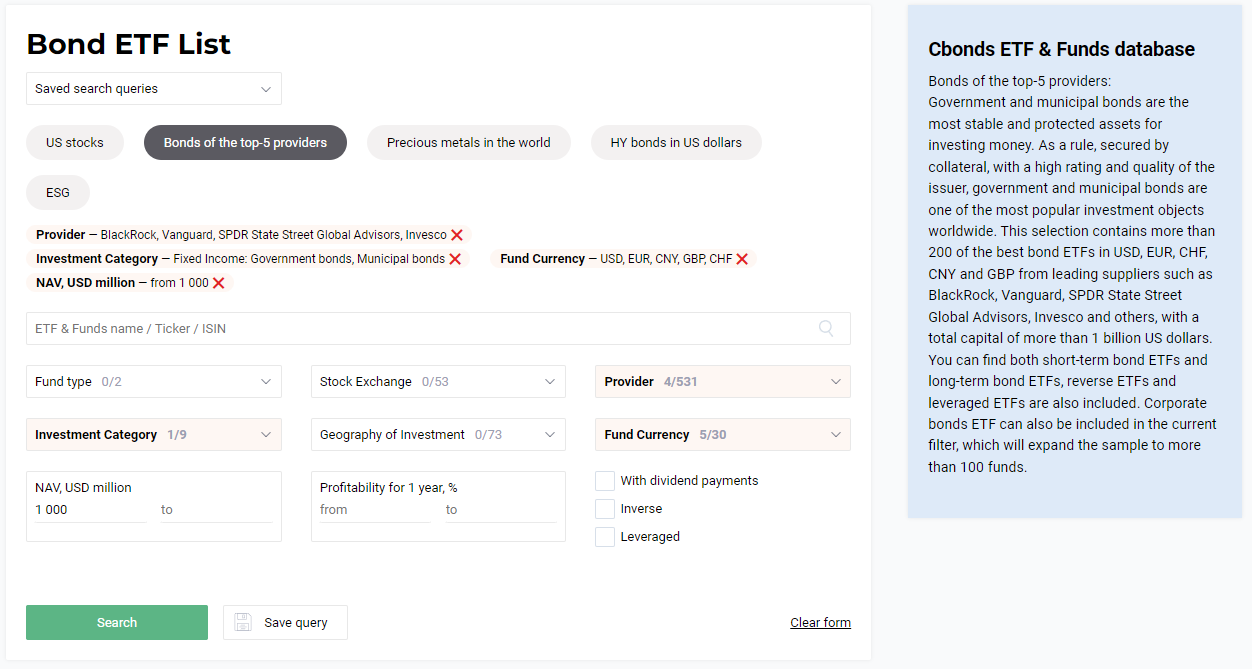

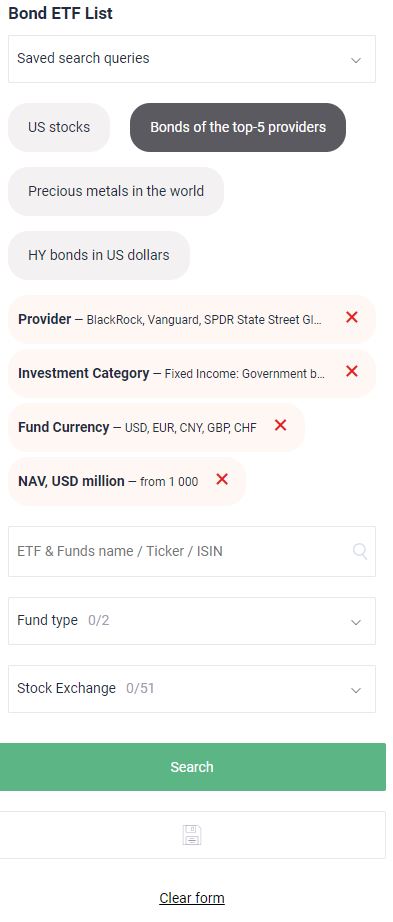

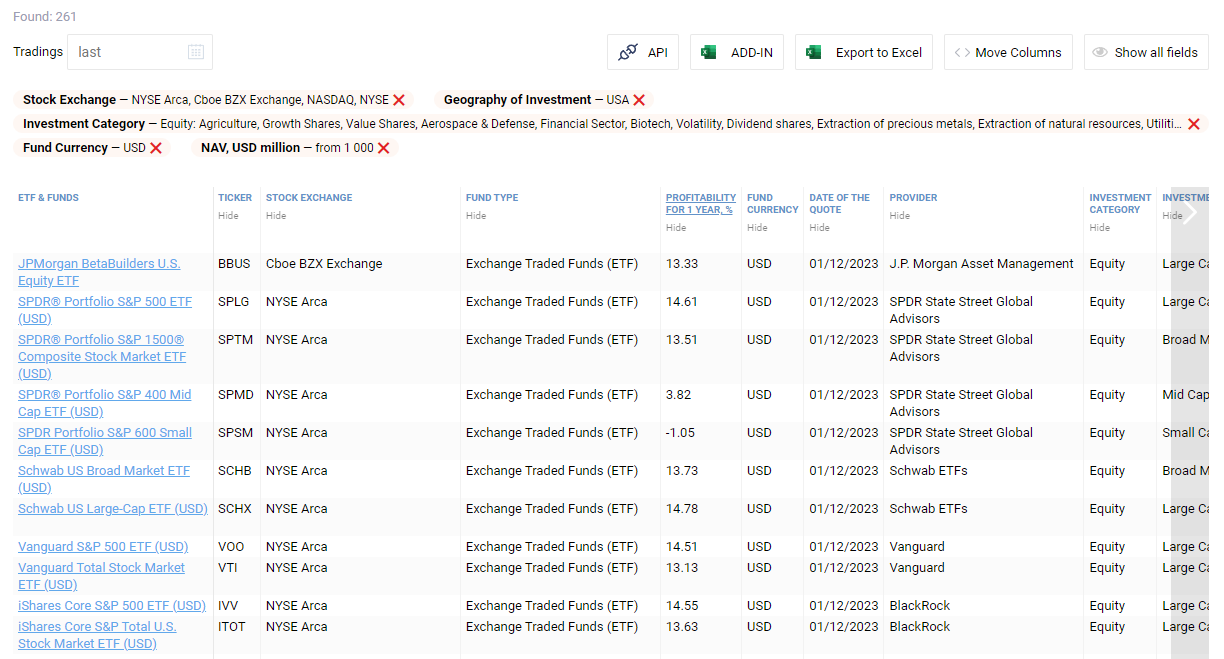

- ETF & Funds

- Indices

- News and Research

- Corporate Actions

-

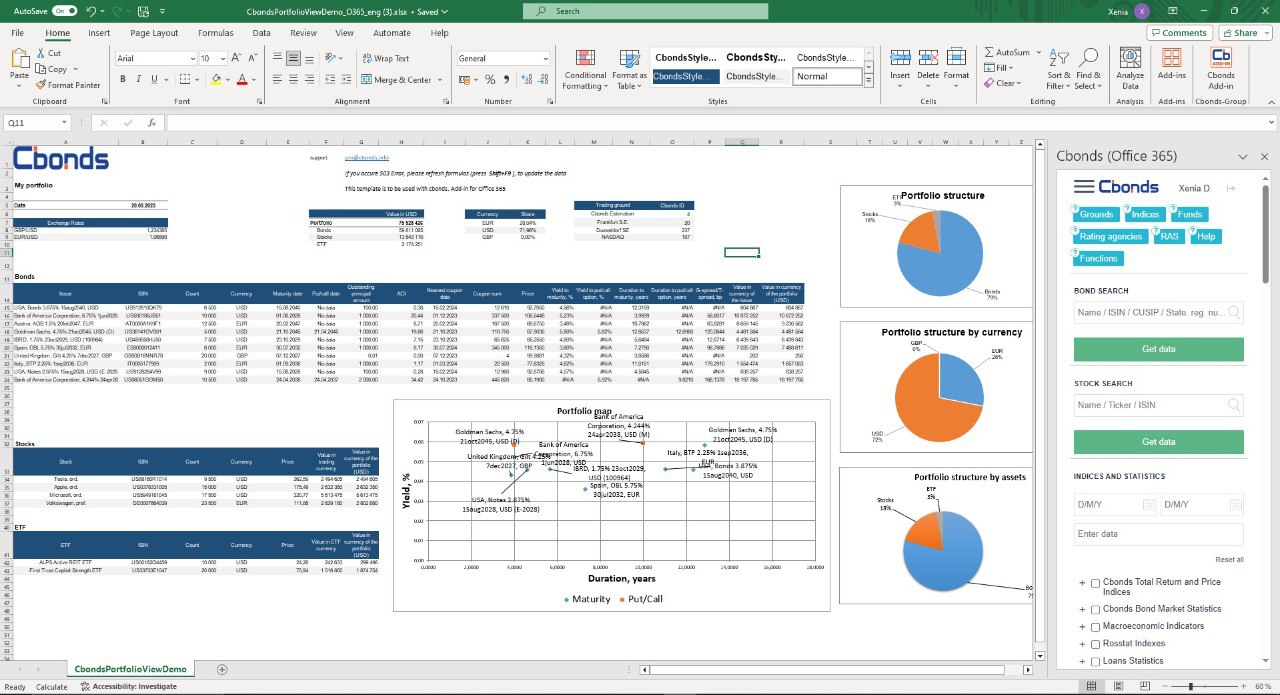

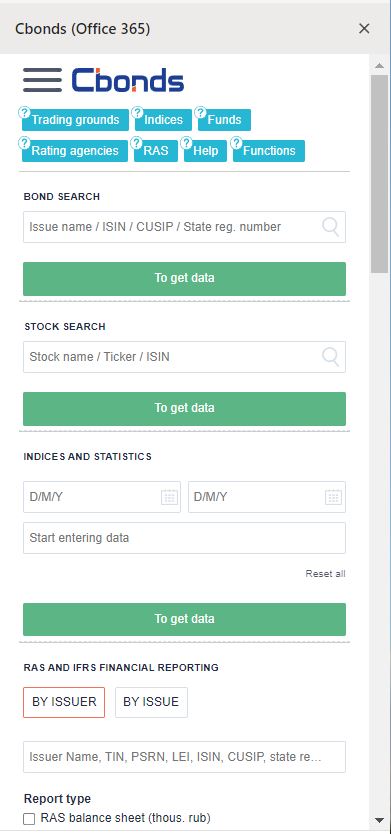

Excel Add-in

-

API

- Get subscription